SCENARIO 14-3

is a measure of the probability that can

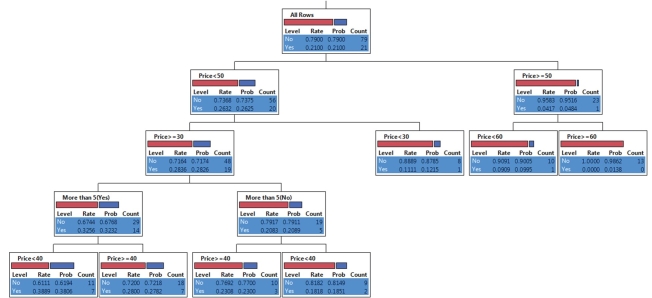

The tree diagram below shows the results of the classification tree model that has been constructed to predict the probability of a cable company's customers who will switch ("Yes" or "No") into its bundled program offering based on the price ($30, $40, $50, $60) and whether the customer spends more than 5 hours a day watching TV ("Yes" or "No") using the data set of 100 customers collected from a survey.

-Referring to SCENARIO 14-3, what percentage of the variation in whether a customer will switch into its bundled program offering can be explained by the price and whether the customer spends more than 5 hours a day watching TV?

Definitions:

Capital

Refers to the financial resources that businesses use to fund their operations and growth.

Firm Value

The total worth of a company, determined by factors like its assets, earnings, and market perception.

Financial Leverage

Employing borrowed capital to enhance the potential profit from an investment, which magnifies both possible rewards and risks.

MM

MM, short for Modigliani and Miller, refers to a foundational theory in finance concerning the capital structure of companies and its impact on market value.

Q15: The largest pool of carbon in the

Q21: Demographically speaking, the effects of AIDS are

Q134: Referring to SCENARIO 15-3, suppose the sample

Q141: Referring to SCENARIO 13-3, what is the

Q169: Referring to SCENARIO 15-9, an R chart

Q170: Referring to Scenario 12-10, the mean weekly

Q212: Referring to SCENARIO 13-17, what are the

Q242: When an additional explanatory variable is introduced

Q248: Referring to SCENARIO 15-4, what is the

Q297: Referring to SCENARIO 13-4, _% of the