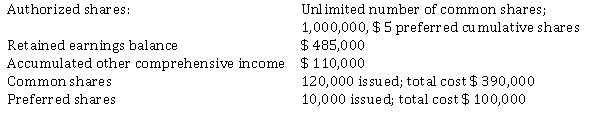

On January 1, 2021, the following information appears in the records of Brown Holdings Inc.:  During the year, the company had the following transactions:

During the year, the company had the following transactions:

Mar 31 Declared cash dividends on common shares of $ 0.50 per share; payable to shareholders of record on April 10, and payable on April 25.

Jun 30 Declared the entire annual dividend required on preferred shares; payable to shareholders of record on July 15, and payable on July 31.

Sep 15 Declared a 10% stock dividend to shareholders of record on October 5, and distributable on October 15.

All dividends were paid or distributed on the due date.

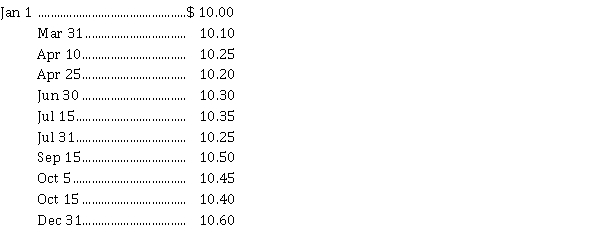

Market price of Brown's common shares at various dates was as follows:  At December 31, 2021 the accounting records indicate that Brown's profit for 2021 was $ 350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $ 28,000.

At December 31, 2021 the accounting records indicate that Brown's profit for 2021 was $ 350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $ 28,000.

Instructions

a) Journalize the dividend transactions.

b) Prepare the statement of changes in shareholders equity for the year ended December 31, 2021.

c) Prepare the shareholders' equity section of Brown's balance sheet at December 31, 2021.

Definitions:

Verbs

Words that express actions, occurrences, or states of being.

Two-Word Stage

Beginning about age 2, the stage in speech development during which a child speaks mostly in two-word statements.

Language Development

The process by which individuals acquire the ability to comprehend and communicate through language, including spoken, written, and sign languages.

Months

Units of time in calendars that approximately correspond to the period of the lunar cycle, used to segment the year.

Q35: In calculating net cash provided by operating

Q88: The overriding criterion in evaluating the accounting

Q93: Accounting information has relevance if it makes

Q103: Under IFRS, cash receipts from interest and

Q111: Vipont Motors has reported the following on

Q117: For companies reporting under ASPE, a long-term

Q159: A $ 300,000 bond was retired at

Q203: Prime is the interest rate that<br>A) a

Q204: Which of the following is the correct

Q235: In a lease contract,<br>A) the owner of