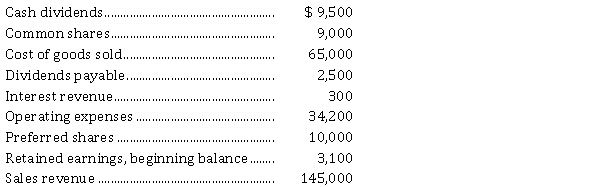

The following information is taken from the trial balance of GlaxonSmith Supplies Ltd. at December 31, 2021, the company's year end. GlaxonSmith has a 25% tax rate. One of the entries making up the balance of retained earnings is an adjustment that was required due to the overstatement of prior year's depreciation expense by $ 1,600 which is net of tax effect.  Instructions

Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2021 using the multiple-step format for the income statement.

Definitions:

Sole Proprietorships

A business structure where the business is owned and run by one individual who bears all the profits and losses.

Q10: Swan Diver Inc. issued $ 400,000 of

Q18: Ms. Drew, Mr. Fraser, and Ms. Percy

Q42: Which of the following statements is incorrect

Q46: In a limited liability partnership, a partner

Q68: An item is considered to be material

Q74: Most of the largest Canadian companies are

Q90: A corporation issued $ 200,000, 10%, 5-year

Q92: At acquisition, a debt instrument is recorded

Q112: On January 1, 2021, Freeman Corporation purchased

Q151: The authorization of share capital will have