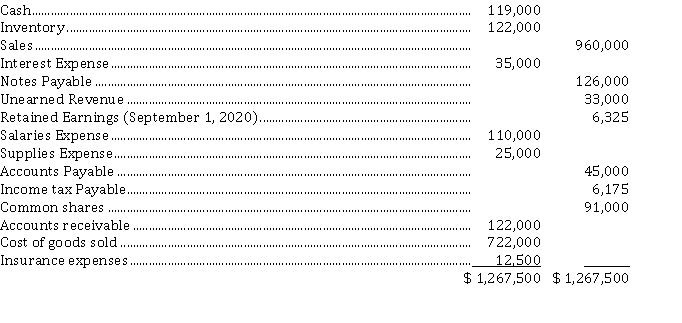

Maki and Leduc Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end August 31, 2021. The following information has been taken from the adjusted trial balance:  Maki and Leduc Inc. has a 15% tax rate.

Maki and Leduc Inc. has a 15% tax rate.

Instructions

a) Prepare a multi-step income statement and the required journal entry to adjust income tax expense.

b) Prepare a statement of retained earnings.

c) Prepare closing entries.

Definitions:

Sherman Act

A landmark federal statute in the field of United States antitrust law passed in 1890 to prohibit monopolies and restrict business practices that reduce market competition.

Monopolization

The process or state by which a single company gains exclusive control over a market, eliminating competition, and often leading to higher prices and reduced quality for consumers.

Tying Agreements

Contracts where the sale of one product (the tying product) is contingent upon the purchase of a second, distinct product (the tied product).

Manufacturers

Entities or individuals involved in the transformation of raw materials or components into finished goods, often utilizing machinery, labor, and efficient production processes.

Q16: When an investor reporting under IFRS owns

Q53: If bonds sell at a premium, the

Q71: The statement of retained earnings<br>A) reports the

Q76: Information pertaining to long-term equity investments in

Q94: The information provided in the notes that

Q101: The conceptual framework of accounting<br>A) ensures that

Q116: On January 1, 2021, Manny Manufacturing Ltd.

Q123: Which of the following statements is not

Q173: One of the disadvantages of a corporation

Q229: Which of the following conditions would not