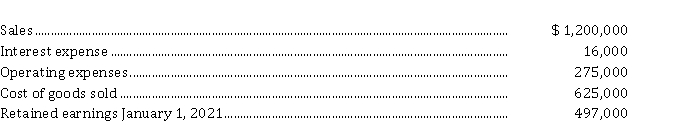

Austrian Limited is a private corporation reporting under ASPE. At December 31, 2021, its general ledger contained the following summary data:  Additional information:

Additional information:

1. In 2021 dividends of $ 35,000 were declared on July 1 and December 31 respectively. The dividends were paid on August 10, 2021 and January 15, 2022 respectively.

2. The company's tax rate is 33%.

Instructions

a) Determine the income tax expense and prepare a multi-step income statement for 2021.

b) Prepare a statement of retained earnings for 2021.

Definitions:

Stress Tolerance

The ability to cope with stress in a healthy way, allowing an individual to face challenging situations without losing efficacy.

Emotional Intelligence

The capacity to be aware of, control, and express one's emotions, and to handle interpersonal relationships judiciously and empathetically.

Risky Behaviors

Actions that involve potential exposure to harm or loss.

Feedback

Information provided by recipients of a service or participants in a process, intended to guide future improvements or actions.

Q1: IFRS will be the standard for all

Q13: Gabrial Ltd. was incorporated February 1, 2021

Q23: Equity instruments held for trading are recorded

Q75: Share capital may be distributed to shareholders

Q84: When equity is issued instead of debt,

Q93: Accounting information has relevance if it makes

Q95: Short-term and long-term debt instruments purchased to

Q96: For companies reporting under IFRS, if 10%

Q119: The amount of dividends paid is reported

Q174: The contractual interest rate and the market