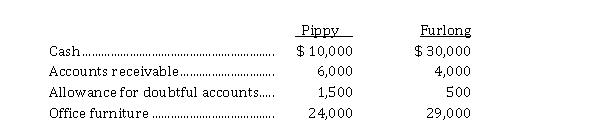

On January 1, 2020, Steve Furlong and Mark Pippy agreed to pool their assets and form a partnership called F&P Computing. They agree to share all profits equally and make the following initial investments:  On December 31, 2020, the partnership reported a loss for the year of $ 19,500. On January 1, 2021, Furlong and Pippy agreed to accept Nicholas Adams into the partnership by purchasing 20% of Pippy's interest in the partnership and 30% of Furlong's interest. The partnership agreement is amended to provide for the following sharing of profit and losses:

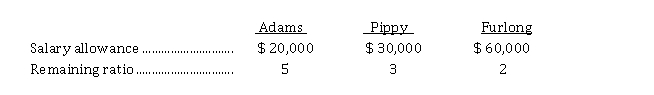

On December 31, 2020, the partnership reported a loss for the year of $ 19,500. On January 1, 2021, Furlong and Pippy agreed to accept Nicholas Adams into the partnership by purchasing 20% of Pippy's interest in the partnership and 30% of Furlong's interest. The partnership agreement is amended to provide for the following sharing of profit and losses:  For the year ended December 31, 2021, profit was $ 350,000.

For the year ended December 31, 2021, profit was $ 350,000.

Instructions

a) Journalize the following transactions:

(1) the initial contributions to the partnership by Furlong and Pippy on January 1, 2020.

(2) the allocation of the loss to the partners at the end of December 2020.

(3) the purchase of the partnership interest by Adams on January 1, 2021.

b) Prepare a schedule to show the division of profit at December 31, 2021.

Definitions:

Expertise

Represents the specialized knowledge or skill in a particular field or area, typically acquired through education, training, and experience.

Organizational Citizenship Behaviors (OCBs)

Voluntary, extra-role activities performed by employees that contribute to the organization's effectiveness but are not part of their formal job responsibilities.

Affect

A broad term that encompasses a range of feelings and emotions individuals experience, often influencing behavior and decision-making.

Low-Mach Individuals

People characterized by their low Machiavellianism; they tend to be straightforward, honest, and trusting in their dealings with others.

Q8: Which of the following would NOT be

Q15: At its December 31 year end, Jamison

Q61: The warranty liability account will be carried

Q73: The profit of the Miskell and Leblanc

Q95: Sean Screen Manufacturing began operations in January

Q97: Which of the following would NOT be

Q105: Determinable liabilities involve no uncertainty about all

Q158: Because of the unlimited liability of partners

Q192: Depreciation is a process of<br>A) asset devaluation.<br>B)

Q199: Austrian Limited is a private corporation reporting