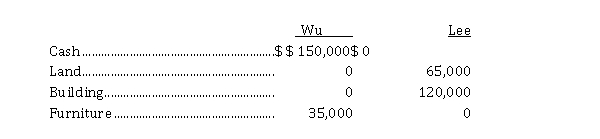

On January 1, 2020, Jacky Wu and Tim Lee decided to form a partnership, dividing all profits and losses equally and by making the following investments:  On December 31, 2020, the partnership reported a profit for the year of $ 28,000. On January 1, 2021, Wu and Lee agreed to accept Jody Smith into the partnership by purchasing 25% of partnership interest for $ 165,000 cash. The partnership agreement is amended to provide for the following sharing of profit and losses:

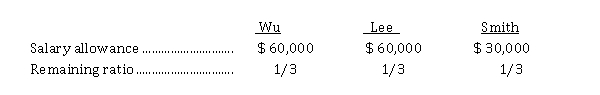

On December 31, 2020, the partnership reported a profit for the year of $ 28,000. On January 1, 2021, Wu and Lee agreed to accept Jody Smith into the partnership by purchasing 25% of partnership interest for $ 165,000 cash. The partnership agreement is amended to provide for the following sharing of profit and losses:  For the year ended December 31, 2021, profit was $ 330,000.

For the year ended December 31, 2021, profit was $ 330,000.

Instructions

a) Journalize the following transactions:

(1) the initial contributions to the partnership by Wu and Lee on January 1, 2020.

(2) the allocation of the profit to the partners at the end of December 2020.

(3) the purchase of the partnership interest by Smith on January 1, 2021.

b) Prepare a schedule to show the division of profit at December 31, 2021.

Definitions:

Perpetual Software Package

A software licensing model where a user pays a one-time fee to use the software indefinitely without subscription fees.

Individual Applications

Separate software programs that fulfill specific tasks or purposes, as opposed to bundled software suites or integrated systems.

Microsoft Email Address

An email account provided by Microsoft, often associated with their Outlook.com or Office 365 services.

Sign-Up Process

The series of steps a user follows to register for an account or service, typically requiring personal information and agreement to terms of service.

Q17: At December 31, 2021, Sookie Limited has

Q37: Which of the following is a situation

Q52: The two ways that a corporation can

Q66: The employer is currently required to pay

Q115: If accounting information has confirmatory value, it<br>A)

Q135: Goodwill CANNOT be sold individually as it

Q146: One characteristic of preferred shares is a

Q170: The four subdivisions for property, plant, and

Q171: A redeemable preferred share gives shareholders the

Q206: The following information is taken from the