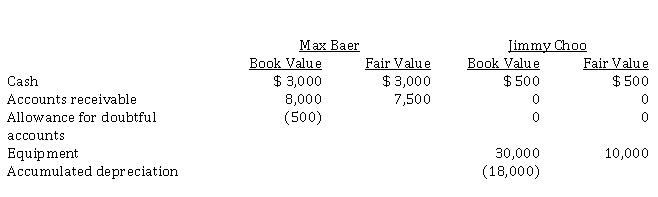

Max Baer and Jimmy Choo are two proprietors who decide to merge their businesses into a partnership on January 1, 2021. The assets each contributed to the partnership are as follows:  During the year ended December 31, 2021, the business, Bear-Chew Pet Services, had revenues of $ 180,000, rent expenses of $ 12,000, depreciation expense of $ 2,500, and other operating expenses of $ 8,400. Other than depreciation expense, all revenues and expenses incurred by the business were for cash. As well, cash of $ 7,500 was collected on the accounts receivable, with the remainder of the accounts receivable written off. The partnership agreement specifies that Max and Jimmy will share the partnership profit equally. During the year, Max withdrew $ 40,000 for personal use, and Jimmy withdrew $ 28,000.

During the year ended December 31, 2021, the business, Bear-Chew Pet Services, had revenues of $ 180,000, rent expenses of $ 12,000, depreciation expense of $ 2,500, and other operating expenses of $ 8,400. Other than depreciation expense, all revenues and expenses incurred by the business were for cash. As well, cash of $ 7,500 was collected on the accounts receivable, with the remainder of the accounts receivable written off. The partnership agreement specifies that Max and Jimmy will share the partnership profit equally. During the year, Max withdrew $ 40,000 for personal use, and Jimmy withdrew $ 28,000.

Instructions

a) Prepare the journal entry to record the two partners' contributions on January 1, 2021.

b) Prepare the partnership's income statement, statement of partners' equity, and balance sheet at December 31, 2021.

Definitions:

Secondary Male Characteristics

Physical changes that occur in males during puberty, such as facial hair, voice deepening, and increased muscle mass, not directly involved in reproduction.

Vas Deferens

A tube that transports sperm from the testicle to the urethra in males.

Surgery

A medical procedure involving the incision or manipulation of tissues to repair or remove pathological conditions.

Antiviral Drugs

Medications used to treat viral infections by inhibiting the development of the offending virus.

Q14: On January 1, 2021, Wallgrub Wholesale Ltd.

Q18: Which of the following best represents the

Q32: Which of the following factors is not

Q86: The investment of assets in a partnership

Q88: The following information is available from the

Q117: All of the following are examples of

Q121: Under ASPE, corporations that issue shares in

Q125: A common application of the cost constraint

Q169: Bancroft Holdings Inc. has authorized share capital

Q203: Authorized share capital is the amount of