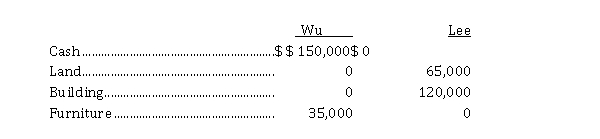

On January 1, 2020, Jacky Wu and Tim Lee decided to form a partnership, dividing all profits and losses equally and by making the following investments:  On December 31, 2020, the partnership reported a profit for the year of $ 28,000. On January 1, 2021, Wu and Lee agreed to accept Jody Smith into the partnership by purchasing 25% of partnership interest for $ 165,000 cash. The partnership agreement is amended to provide for the following sharing of profit and losses:

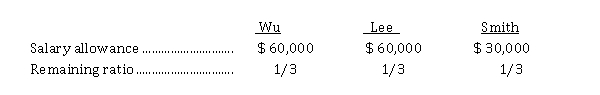

On December 31, 2020, the partnership reported a profit for the year of $ 28,000. On January 1, 2021, Wu and Lee agreed to accept Jody Smith into the partnership by purchasing 25% of partnership interest for $ 165,000 cash. The partnership agreement is amended to provide for the following sharing of profit and losses:  For the year ended December 31, 2021, profit was $ 330,000.

For the year ended December 31, 2021, profit was $ 330,000.

Instructions

a) Journalize the following transactions:

(1) the initial contributions to the partnership by Wu and Lee on January 1, 2020.

(2) the allocation of the profit to the partners at the end of December 2020.

(3) the purchase of the partnership interest by Smith on January 1, 2021.

b) Prepare a schedule to show the division of profit at December 31, 2021.

Definitions:

Q4: The objective of financial reporting is to

Q19: United Health is considering two alternatives for

Q48: Organization costs are normally capitalized by public

Q51: City Wok Inc. paid $ 5,600 for

Q53: Timeliness means that accounting information is provided

Q75: Share capital may be distributed to shareholders

Q92: At the time of acquisition, long-lived assets

Q120: If a note payable is payable in

Q139: A partnership must make a profit.

Q159: A bonus to the remaining partners may