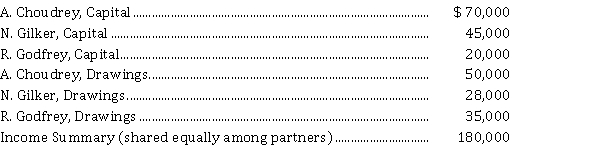

The following information is available regarding CGG Company's partnership accounts at December 31, 2021, before completion of the closing entries:  No new contributions were made during 2021. Godfrey wishes to withdraw from the partnership January 1, 2022.

No new contributions were made during 2021. Godfrey wishes to withdraw from the partnership January 1, 2022.

Instructions

a) Prepare the statement of partners' equity for the year ended December 31, 2021.

b) Prepare the January 1, 2022 entry to record Godfrey's withdrawal under each of the following three independent alternatives:

(i) Choudrey and Gilker each pay Godfrey $ 10,000 out of their personal accounts and each receives one-half of Godfrey's equity.

(ii) Godfrey is paid $ 100,000 out of partnership cash.

(iii) Godfrey is paid $ 40,000 out of partnership cash.

Definitions:

Decision-Making Process

The steps or stages involved in choosing a course of action from several alternatives, typically involving problem identification, analysis, and the selection of the best solution.

Ethical Soundness

A measure of how closely actions or policies align with widely accepted moral principles.

Evaluating Alternative Solutions

The process of examining and comparing different options or approaches to address a problem or achieve a goal, in order to select the most suitable one.

Decision-making Process

The decision-making process involves identifying and choosing alternatives based on values, preferences, and beliefs of the decision-maker.

Q12: Hanna Manufacturing Limited receives $ 240,000 on

Q37: Dividends are distributed from retained earnings.

Q59: Payments by employers to retired employees _<br>A)Current

Q77: Relevant accounting information<br>A) is information that has

Q100: The cost of property, plant, and equipment

Q107: The profit of the Busch and Ford

Q126: A partner pays income tax on the

Q133: A loss on disposal of long-lived assets

Q155: Jet Fuel Ltd. has a customer rewards

Q184: As interest is recorded on an interest-bearing