Refer to the information below for questions

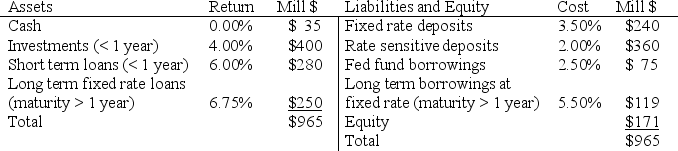

Formosa Independence Bank has the following balance sheet:

-If all interest rates on the two sides of balance sheet decline by 65 basis points, when other things are equal, what is the change in net interest income for Formosa Independence Bank over the year?

Definitions:

Growing Annuity

A series of cash flows that grow at a constant rate for a finite number of periods.

Cash Flow Growth Rate

The rate at which a company's cash flow increases over a certain period, reflecting financial health and profitability potential.

Required Rate of Return

The minimum yearly percentage profit necessary for persuading individuals or corporations to invest in a particular security or initiative.

APR

The Annual Percentage Rate, a measure of the total cost of credit to the borrower on an annual basis, including interest and transaction fees.

Q1: What are the benefits that investment companies

Q11: When joining a country club, a potential

Q14: A lender with a fixed-rate mortgage bears

Q17: Large banks tend to rely more on

Q26: _ is considered the first major water

Q27: What is the bank's duration gap in

Q30: No-load mutual funds are commonly sold by

Q34: Explain how unexpected increases in interest rates

Q37: A subprime mortgage is a mortgage made

Q69: If a bank specializes in mortgage lending