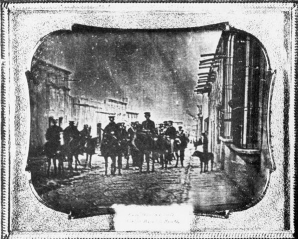

-How does Nathaniel Currier's lithograph on the right portraying the death of Colonel Henry Clay Jr. at the Battle of Buena Vista during the Mexican War differ from the daguerreotype on the left of Brigadier General John E. Wool and his staff in Saltillo, Mexico?

Definitions:

Salvage Value

The anticipated market price of an asset at the conclusion of its effective life.

Operating Costs

Expenses associated with the day-to-day functions of a business, excluding costs related to the production of goods.

Useful Life

The estimated time period that an asset is expected to be operational and economically useful to the owner.

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment or project, calculated by discounting future cash flows to their present value and subtracting the initial investment cost.

Q4: The passage of the Sheppard-Towner Act in

Q4: The successful passage of the initiative, referendum,

Q4: What does this photograph labeled "The Cotton

Q12: What was the primary reason why the

Q17: The scene in John Lewis Krimmel's Fourth

Q20: Puritan minister Increase Mather reported that after

Q36: "Paper sons" were .<br>A) Chinese boys whose

Q39: The "starving time" refers to an event

Q41: One reason that Mexico became concerned with

Q49: How did John Vanderlyn's painting depicting the