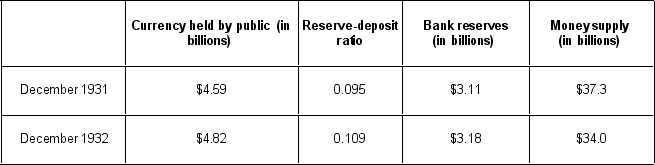

Based on the information in the table, if the public had not decided to hold more currency in 1932, but the actions of the Federal Reserve and the banks remained the same, the money supply at the end of 1932 would have been:

Definitions:

Forecasting Errors

Discrepancies between predicted values and actual values that occur when projecting future data points or trends.

Passive Investments

Investment strategies that involve minimal buying and selling actions, typically focused on long-term appreciation and mimicking market or sector indexes.

Regret Avoidance

Notion from behavioral finance that individuals who make decisions that turn out badly will have more regret when that decision was more unconventional.

Overconfidence

A cognitive bias where an individual overestimates their abilities or the precision of their knowledge, often leading to mistakes in judgment.

Q1: Based on the newspaper in the photograph,

Q2: The Green Party candidate in the 2000

Q12: Refer to the figure below. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3718/.jpg"

Q23: A central bank that attempts to achieve

Q25: What common factor did all of the

Q65: For a given inflation rate, if concerns

Q71: Prior to January 2000, the demand for

Q84: Financial intermediaries, such as commercial banks, help

Q88: A large increase in oil prices is

Q92: Prior to January 2000, the demand for