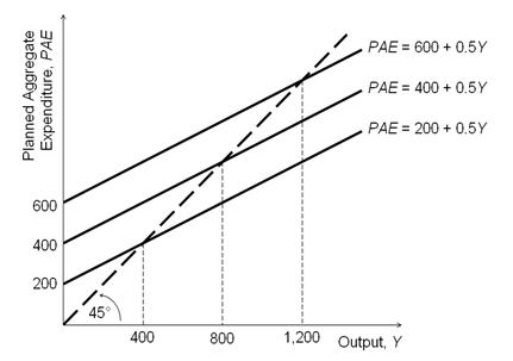

Refer to the figure below.  Based on the figure, when PAE = 400 + 0.5Y, short-run equilibrium output equals:

Based on the figure, when PAE = 400 + 0.5Y, short-run equilibrium output equals:

Definitions:

Systematic Risk

The risk inherent to the entire market or market segment, which cannot be mitigated through diversification.

Beta Value

A measure of a stock's volatility in relation to the overall market, indicating the level of risk associated with the stock.

Unsystematic Risk

The risk associated with a specific company or industry, also known as non-systemic risk, which can be mitigated through diversification.

Risk Premium

The extra return expected by investors for taking on a higher level of risk compared to a risk-free investment.

Q15: If actual output equals potential output, unusually

Q41: Stock prices increase when expected future dividends

Q58: If a bank's desired reserve/deposit ratio is

Q69: Which of the following policies is likely

Q73: When the Fed sells government securities, the

Q77: The direct trade of goods and services

Q105: Federal Reserve actions that increase nominal interest

Q107: For an economy starting at potential output,

Q121: In the basic Keynesian model, a decrease

Q164: Public saving is negative when:<br>A)there is a