Use the following information for Questions

Yueve's Company is negotiating leases for three store locations.Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unknown (it is impracticable to determine) .

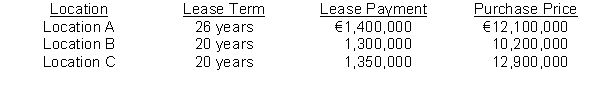

Each store will have a useful economic life of 30 years.Lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

-On January 1, 2016, Dean Corporation signed a ten-year noncancelable lease for certain machinery.The terms of the lease called for Dean to make annual payments of $100,000 at the end of each year for ten years with title to pass to Dean at the end of this period.The machinery has an estimated useful life of 15 years and no residual value.Dean uses the straight-line method of depreciation for all of its fixed assets.Dean accordingly accounted for this lease transaction as a finance lease.The lease payments were determined to have a present value of $671,008 at an effective interest rate of 8%.With respect to this capitalized lease, Dean should record for 2016

Definitions:

Negotiate

The process of discussing, debating, and eventually reaching an agreement or compromise between parties with different interests or perspectives.

Union Organizing Campaign

A collective effort aimed at gaining recognition for a labor union as the bargaining representative for a group of workers.

Tactics

Methods or strategies carefully planned to achieve a specific end, often used in the context of negotiations, competitions, or conflicts.

Legal And Illegal

Terms that distinguish between actions or practices that are authorized or forbidden by law, respectively.

Q3: If Al has an absolute advantage over

Q3: The methods of accounting for a lease

Q11: Which of the following disclosures of pension

Q34: Which of the following would be classified

Q44: Callable preference shares permit the corporation at

Q49: Qualified pension plans permit tax-free status of

Q54: Which of the following are defined as

Q68: Which of the following under IFRS, but

Q68: Which of the following subsequent events would

Q77: Shareholders of a business enterprise are said