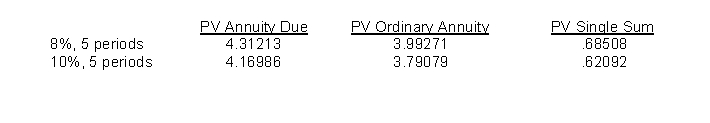

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2016 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the amount of interest expense recorded by Silver Point Co.for the year ended December 31, 2016?

Definitions:

Q3: Matt has decided to purchase his textbooks

Q6: <sup> </sup>30.At the December 31, 2015 statement

Q14: The unexpected gains and losses from changes

Q26: Refer to the figure below.This economy would

Q41: The basic limitations associated with ratio analysis

Q45: A company changes from percentage-of-completion to cost-recovery,

Q56: One component of pension expense is interest

Q57: Earth Movers & Shakers operates 3 iron

Q70: When the lessee agrees to make up

Q76: Which of the following represents the total