Use the following information for Questions

Yueve's Company is negotiating leases for three store locations.Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unknown (it is impracticable to determine) .

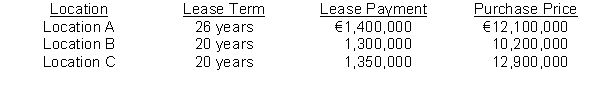

Each store will have a useful economic life of 30 years.Lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

-On January 1, 2016, Dean Corporation signed a ten-year noncancelable lease for certain machinery.The terms of the lease called for Dean to make annual payments of $100,000 at the end of each year for ten years with title to pass to Dean at the end of this period.The machinery has an estimated useful life of 15 years and no residual value.Dean uses the straight-line method of depreciation for all of its fixed assets.Dean accordingly accounted for this lease transaction as a finance lease.The lease payments were determined to have a present value of $671,008 at an effective interest rate of 8%.With respect to this capitalized lease, Dean should record for 2016

Definitions:

Direct Labor

The labor costs directly traceable to the production of goods or services, such as wages paid to workers or machine operators.

Fixed Overhead

Overhead expenses that remain constant regardless of a company's level of production or sales.

Raw Material

Basic materials used in the production process that are transformed into finished goods through manufacturing.

Fixed Overhead

Costs that do not vary with the level of production or sales, including rent, salaries, and insurance, necessary for maintaining a business’s operations.

Q10: Companies can use the expected value to

Q15: Amortized cost is the initial recognition amount

Q28: Machinery was acquired at the beginning of

Q35: The difference between a financial forecast and

Q37: If there is a lack of conformity

Q39: You are the Minister of Trade for

Q47: All of the following statements are true

Q57: IFRS requires that convertible debt be separated

Q69: In order to properly record a direct-financing

Q72: Mae Jong Corp.issues 1,000 convertible bonds at