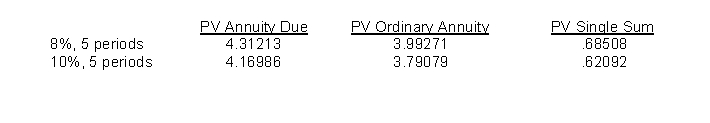

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2016 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the amount of interest expense recorded by Silver Point Co.for the year ended December 31, 2016?

Definitions:

Monthly Interest Rate

The interest rate charged or earned, expressed on a monthly basis, typically used for loans or investments.

Monthly Interest Rate

It's the interest rate applied each month on loans, savings, or investments, calculated by dividing the annual interest rate by 12.

Q2: If companies want to disqualify a lease

Q11: Which of the following disclosures of pension

Q11: Cash, short-term investments, and net receivables are

Q35: On May 1, 2016, Marly should record

Q39: Other types of information found in the

Q40: IFRS requires that<br>A)all companies that issue an

Q45: Consideration paid or payable to customers<br>A)includes volume

Q51: Regarding the alternatives for measuring the pension

Q84: Under the cost-recovery method<br>A)revenue, cost, and gross

Q95: Economists use abstract models because:<br>A)every economic situation