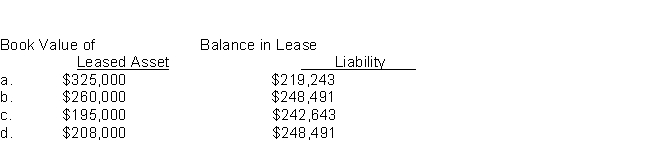

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2016 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments of $73,259 at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the book value of the leased asset at December 31, 2016, and what is the balance in the Lease Liability account?

Definitions:

Note Duration

The length of time until a promissory note, or loan agreement, is due to be paid in full.

Face Value

The nominal or dollar value printed on a financial instrument, such as a bond or stock certificate, indicating its worth at issuance.

Interest Rate

The percentage charged on the total amount of borrowed money or paid on investments, over a specific period of time.

Maturity Value

The total amount that will be paid to an investor at the end of a fixed-income security's term, including both the original principal and the interest earned.

Q2: Equity security holdings between 20 and 50

Q6: A qualified opinion is issued when the

Q7: All of the following statements are true

Q8: An entry is not made on the<br>A)date

Q22: Under the equity method of accounting for

Q27: On January 1, 2015, Ritter Company granted

Q32: The balance in Ordinary Share Dividend Distributable

Q33: A contract<br>A)must be in writing to be

Q34: If an IASB standard creates a new

Q79: When a company amends a pension plan,