The unexpected gains or losses that result from changes in the defined benefit obligation are called

Definitions:

Depreciable Assets

Assets subject to depreciation, reflecting the reduction in value due to wear and tear, decay, or decline in usefulness over time.

Cash Flow

The net amount of cash being transferred into and out of a business, which is used to maintain the company's operations.

Operating Activities

Business actions directly related to its day-to-day operations, such as selling products or services, which generate revenue and expenses.

Amortization Expense

The systematic allocation of the cost of an intangible asset over its useful life.

Q17: A company should report per share amounts

Q23: When a note payable is exchanged for

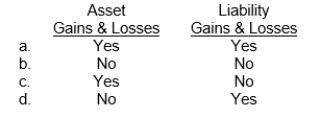

Q39: Gains or losses on cash flow hedges

Q45: A company changes from percentage-of-completion to cost-recovery,

Q54: In a debt settlement in which the

Q71: An employer does not have to report

Q78: A lessor with a sales-type lease involving

Q83: If a linear, twogood production possibilities curve

Q84: You are the Minister of Trade for

Q88: Both a guaranteed and an unguaranteed residual