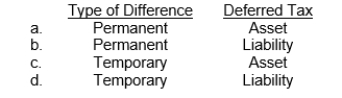

A company uses the equity method to account for an investment.This would result in what type of difference and in what type of deferred income tax?

Definitions:

Note Receivable

A note receivable is a written promise that indicates another party's obligation to pay a specific sum of money to the holder of the note by a certain date.

Cash Equivalents

Short-term, highly liquid investments that are readily convertible to known amounts of cash and have original maturities of three months or less.

Financial Statements

Reports that summarize the financial performance, position, and cash flows of a business for a specific period.

Disclosure

The act of providing important information to stakeholders, required by regulations to ensure transparency and fairness in financial reporting and corporate actions.

Q2: For share appreciation rights that are a

Q6: Disclosure related to revenue<br>A)does not require capitalized

Q18: Debt investments that are accounted for and

Q20: The major difference between convertible debt and

Q31: A financial projection is a set of

Q31: Share dividends distributable should be classified on

Q52: Yancey, Inc.would record depreciation expense on this

Q52: Stone Company changed its method of pricing

Q57: An operating segment is a reportable segment

Q61: In a defined-benefit plan, a formula is