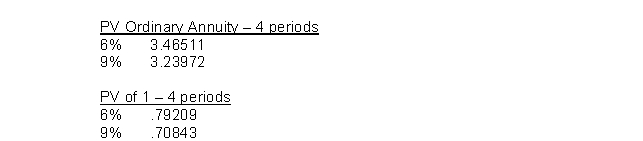

Mae Jong Corp.issues 1,000 convertible bonds at the beginning of 2015.The bonds have a four-year term with a stated rate of interest of 6 percent, and are issued at par with a face value of €1,000 per bond (the total proceeds received from issuance of the bonds are €1,000,000) .Interest is payable annually at December 31.Each bond is convertible into 250 ordinary shares with a par value of €1.The market rate of interest on similar non-convertible debt is 9 percent.When Mae Jong records the issuance of these bonds, how much will it credit to Share Premium-Conversion Equity? The following present value factors are available:

Definitions:

Bad Debt Expense

An income statement item reflecting the cost associated with the estimated uncollectible accounts receivable.

Allowance for Doubtful Accounts

An estimate of the amount of accounts receivable that may not be collected, recognized as a contra asset account.

Cash Realizable Value

The net amount of cash expected to be received from receivables, after accounting for allowances for doubtful accounts.

Accounts Receivable

Debts owed by customers to a company for delivered goods or performed services that remain unpaid.

Q3: When bonds are issued at a premium,

Q4: If preference shares are cumulative and no

Q8: If the market rate is greater than

Q22: Mika company leases telecommunication equipment.Assume the following

Q39: For counterbalancing errors, restatement of comparative financial

Q44: Investments in trading debt investments are generally

Q50: A pension liability is reported when<br>A)the defined

Q52: Stone Company changed its method of pricing

Q63: Many companies pay dividends in amounts equal

Q71: In selecting an accounting method for a