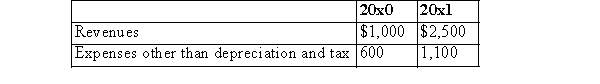

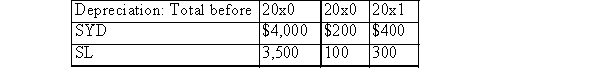

Information for a firm making an accounting change follows:  Tax rate: 30%

Tax rate: 30%

Common shares outstanding entire year for both years: 100; Retained earnings, 1/1/x0: $6,000

The firm changes from SYD to SL depreciation in 20x1 for financial reporting purposes only.  Required:

Required:

(a)The 20x1 entries to record the accounting change and depreciation expense for 20x1.

(b)The comparative 20x0 and 20x1 income statements including pro forma disclosures if needed, EPS, and any disclosure footnote required.

Definitions:

Infraction

A minor violation of a rule or law, typically not punishable by imprisonment.

Petty Offense

In criminal law, the least serious kind of wrong, such as a traffic or building code violation.

U.S. Congress

The bicameral legislative body of the United States federal government, consisting of two chambers: the Senate and the House of Representatives.

Federal Crimes

Illegal acts that violate the laws of the federal government of a country, as opposed to state or local laws.

Q7: For a finance lease, an amount equal

Q9: Provided that the conditions for share issuance

Q34: On January 1, 2015, JTC changed to

Q37: Nonconvertible, cumulative, preferred shares affect the computation

Q40: Early adoption of involuntary changes in accounting

Q47: Today is John's 57th birthday and he

Q54: Which one of the following statements is

Q57: The 2014 net income of MNO was

Q78: The minimum takeoff speed for a certain

Q120: A preferred dividend claim should be subtracted