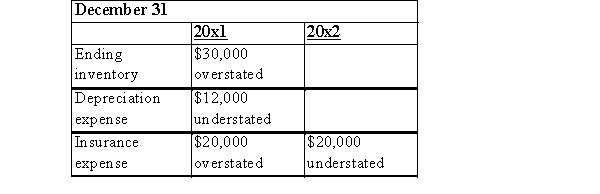

BVC began operations January 1, 20x1.Financial statements for the year ended December 31, 20x1, and 20x2, contained the following errors:  In addition, on December 26, 20x2, fully depreciated machinery was sold for $21,600 cash, but the sale was not recorded until 20x3. There were no other errors during 20x1 or 20x2, and no corrections have been made for any of the errors.

In addition, on December 26, 20x2, fully depreciated machinery was sold for $21,600 cash, but the sale was not recorded until 20x3. There were no other errors during 20x1 or 20x2, and no corrections have been made for any of the errors.

What is the total pre-tax effect of the errors on 20x2 net income?

Definitions:

Bargaining Outcomes

The results achieved from negotiation processes, including agreements on wages, working conditions, and other employment terms.

Strike Activity

The act of employees stopping work in protest against their employment conditions, aiming to pressure employers to meet their demands.

Strike Replacements

Workers who are hired to fill in for employees who are on strike, often to keep the company operational during labor disputes.

Defensive Lockout

A strategy used by employers to prevent employees from working during a labor dispute to protect the company's assets or interests.

Q23: A race car will make one

Q25: The concept of consistency is sacrificed in

Q32: Which one of the following choices is

Q61: A motorcycle has a velocity of 24

Q63: A corporation has a machine that cost

Q75: EPS figures must be disclosed on the

Q88: Post-retirement benefits other than pensions must now

Q102: In a sale and leaseback situation<br>A)the lessee

Q104: Which of the following is included in

Q116: If a company's ratio of net income