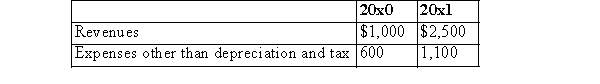

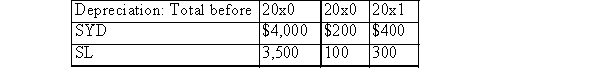

Information for a firm making an accounting change follows:  Tax rate: 30%

Tax rate: 30%

Common shares outstanding entire year for both years: 100; Retained earnings, 1/1/x0: $6,000

The firm changes from SYD to SL depreciation in 20x1 for financial reporting purposes only.  Required:

Required:

(a)The 20x1 entries to record the accounting change and depreciation expense for 20x1.

(b)The comparative 20x0 and 20x1 income statements including pro forma disclosures if needed, EPS, and any disclosure footnote required.

Definitions:

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the standard cost allocated, based on the actual activity level.

Variable Overhead Standards

The predetermined costs associated with variable overheads that are expected to be incurred under normal operating conditions.

Direct Labor-hours

The total hours worked directly on manufacturing a product or providing a service, used as a basis for allocating labor costs in product costing.

Quantity Standard

Pre-determined measure set for the amount of input that should be used in producing a unit of output.

Q13: What is the purpose of consolidated financial

Q38: A ferry can travel at an optimal

Q61: A motorcycle has a velocity of 24

Q71: If business conditions are stable, an increase

Q71: Bonnie joined a firm at age 25

Q81: When a pension plan is ended, the

Q88: An adverse opinion is given if the

Q199: This question relates to the different types

Q217: Under a sales-type lease, the difference between

Q219: When the lessor is financial intermediary, a