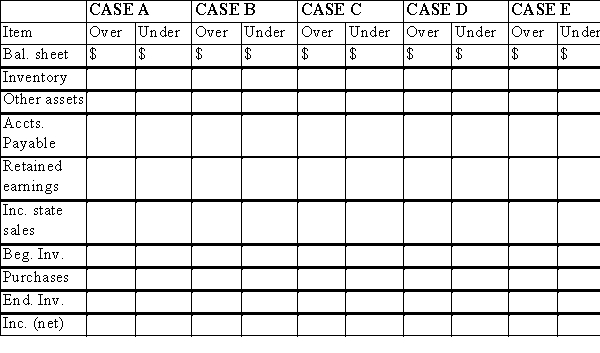

Following are five separate and completely independent cases:

CASE A: A $700 item was excluded incorrectly from the ending inventory; the related purchase was not recorded.

CASE B: A $200 item was included incorrectly in the ending inventory; the related purchase was

recorded.

CASE C: A $900 item was included incorrectly in the ending inventory; the related purchase was not recorded.

CASE D: A $500 item was excluded incorrectly from ending inventory; the related purchase was recorded.

CASE E: The beginning inventory was Overstated $400.

Enter dollar amounts where appropriate in the following tabulation to indicate the effect on the financial statements of each of the items given above (disregard income tax).

Definitions:

Q1: A candy shop sells a pound of

Q30: FED had 100 common shares issued and

Q31: City A lies 30 km directly south

Q57: All of the following are relevant policy

Q79: How is the cash flow statement impacted

Q89: What is the average velocity of the

Q95: What is the velocity of the object

Q97: GXC Inc.committed the following errors during 20x1,

Q108: A finance lease signed on January 1,

Q116: If a company's ratio of net income