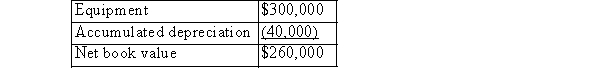

Depreciation expense for the most recent fiscal year on equipment purchased a few years ago is

$10,000.The balance sheet at the end of the same year disclosed the following:  The asset is not expected to have a salvage value and the firm depreciates the asset on the straight-lin basis.In March of the NEXT year (the year of change), the firm decided to reduce the original total useful life 20% and that a salvage value of $30,000 is a reasonable estimate.The firm also decided that the double declining balance method is a more appropriate depreciation method for this asset.

The asset is not expected to have a salvage value and the firm depreciates the asset on the straight-lin basis.In March of the NEXT year (the year of change), the firm decided to reduce the original total useful life 20% and that a salvage value of $30,000 is a reasonable estimate.The firm also decided that the double declining balance method is a more appropriate depreciation method for this asset.

Required:

(a)The entry to record the accounting change.

(b)The entry to record depreciation expense in the year of change.

Definitions:

Birds

Warm-blooded vertebrates with feathers, capable of flight, with a beak but no teeth, laying hard-shelled eggs.

Fishes

Aquatic, gill-bearing animals that lack limbs with digits, often covered in scales, and residing in both freshwater and saltwater environments.

Flatworm

A group of simple invertebrates known for their flat bodies, including both free-living and parasitic species like tapeworms.

Q2: Jamieson's pension expense as per ASPE for

Q11: RST entered into a sales-type lease with

Q17: The decision to capitalize (as opposed to

Q24: Diluted earnings per share recalculate EPS as

Q49: A pole is held vertically by attaching

Q61: DEF wrote off a $300 uncollectible account

Q73: Two cars travel along a level highway.It

Q89: What is the average velocity of the

Q162: What is the purpose of the times

Q165: A trade creditor will be primarily interested