LAC has negotiated a lease agreement with LEC effective January 1, 2014.LAC will provide LEC with a special-purpose building for ten (10)years.The lease is non-cancellable; requires LEC to provide maintenance, insurance, taxes, etc.; and stipulates that the building reverts back to LAC's control at the end of the lease.The building cost LAC $200,000 and is expected to have no residual value at the end of the lease.LAC expects a 15% return on investments and the lease qualifies as a direct financing lease.Rents are paid each December 31 starting in 2014.

(a)How much annual rent will the lessee pay (rounded to the nearest dollar)? $ _.

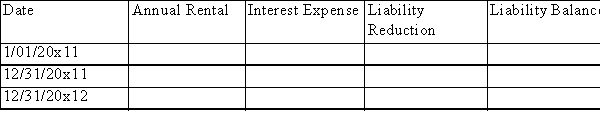

(b)Complete the following schedule of lease amortization for the lessee for the first two years:  (c)Complete the following entries for the lessee: January 1, 2014, inception of lease.

(c)Complete the following entries for the lessee: January 1, 2014, inception of lease.

December 31, 2014, first rental payment and lessee's year-end entries (end of the accounting period).December 31, 2014, accrual by lessee of $4,000 taxes on the building and payment of $800 for repairs on the building.

Definitions:

Thoughts

Mental processes or ideas that are produced by cognitive activities in the brain.

Endless Flow

A continuous, uninterrupted stream or sequence of activity or events.

Brain Wave

Oscillations of electrical potential between parts of the brain, visible on an EEG.

Beta Waves

Brainwaves that are associated with active, alert, and cognitive processing states of consciousness.

Q25: The following information pertains to XYZ Inc.:

Q38: EGR Company provided you with the following

Q40: Retractable preferred shares are always classified as

Q54: Stock rights, options, and warrants determined to

Q56: An example of a "deductible amount" occurs

Q60: When stock rights are issued to current

Q111: Fractional share rights are usually issued:<br>A)At the

Q118: ABC Inc., a publicly traded company, 100,000

Q191: XYZ Rental leased a special crane to

Q215: Amanda Company leased an office building for