Lessor Company leases small computers on three-year leases at the end of which the residual value

is not material in amount.Rents are collected at year-end.On January 1, 2014, Lessor signed a 3-year lease with Lessee Company that called for annual rents of $12,063, which was a return to

Lessor of 10% on the $30,000 cost (market value at date of lease).Assume the lease qualifies as a direct financing lease to the lessor and a finance lease to the lessee.There was no bargain purchase option or residual value.The lessee's incremental borrowing rate is 12%.

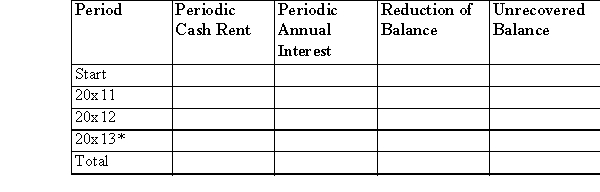

(a)Complete the following amortization schedule for the lease.Round to the nearest dollar.  * May have slight rounding error.

* May have slight rounding error.

(b)Can both the lessor and lessee use the amortization schedule values in this instance? Yes ________ No ________

Explain why _.

(c)Give the entries for the lessor and lessee on the following dates (assume the accounting period ends December 31).Use the abbreviated account titles.

January 1, 2014-Inception of the lease:

December 31, 2014-Interest date and end of accounting period (give all entries except closing entries):

December 31, 2014-Interest date and end of accounting period (give all entries except closing entries):

Definitions:

Social Class

A division of society based on social and economic status, often influencing individuals' opportunities, lifestyles, and attitudes.

Everyday Habit

refers to routine behaviors or practices that individuals perform regularly without much thought.

Life Chances

The opportunities that people have in common by virtue of belonging to a particular class.

Class Revolution

A fundamental and profound change in a society's class structure, often associated with social and political upheaval aimed at redistributing power and resources.

Q29: The conversion of preferred shares at a

Q29: What factor would most likely cause a

Q46: On January 1, 2014, a lessor and

Q47: Jimbo Co.began operations Jan.1, 2014.The following events

Q81: A reverse split may be used to

Q90: If the lessor and lessee use different

Q108: Mutual companies will tend to record their

Q163: IFRS requires that any public company repurchasing

Q170: On January 1, 2014, BE Company collected

Q191: XYZ Rental leased a special crane to