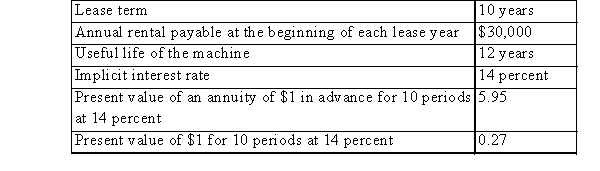

ABC INC.leased a new machine from QRS on July 1, 2014, under a lease with the following pertinent information:  ABC INC.has the option to purchase the machine at the end of the lease term, by paying $40,000, which approximates the expected fair value of the machine on the option exercise date.The cost of the machine on QRS's accounting records is $150,000.On July 1, 2014, ABC INC.should record a net capitalized leased asset of:

ABC INC.has the option to purchase the machine at the end of the lease term, by paying $40,000, which approximates the expected fair value of the machine on the option exercise date.The cost of the machine on QRS's accounting records is $150,000.On July 1, 2014, ABC INC.should record a net capitalized leased asset of:

Definitions:

Deviance

Behaviors or actions that violate societal norms or expectations.

White-Collar Crime

Non-violent crime committed by individuals, typically for financial gain, within their occupational roles.

Society's Cost

Refers to the economic and social costs borne by the society at large, as a result of individual or corporate activities, which are not reflected in the price of goods or services, including pollution, health issues, and social disparities.

Violent Crime

Acts that involve force or threat of force, including murder, rape, robbery, and aggravated assault.

Q16: A tax loss represents the present and

Q17: How does a trustee impact upon accounting

Q42: Choose the best statement with respect to

Q59: Pension plans that are registered meet Revenue

Q65: At December 31, 2014, the shareholders' equity

Q79: If a company's ratio of net income

Q84: Convertible bonds with a floating conversion price

Q102: Financial analysts tend to ignore deferred taxes

Q110: At December 31, 2013, GHI had 400

Q123: Transactions that take place in the period