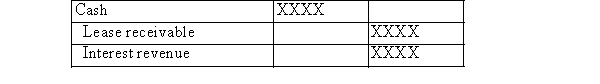

LMN made the following journal entry relating to a finance lease:  Therefore, LMN must be the:

Therefore, LMN must be the:

Definitions:

Comparative Balance Sheets

Financial statements that display a company's financial position at different points in time side by side, facilitating year-over-year or period-over-period comparison.

Depreciation Expense

The allocation of the cost of tangible assets over their useful lives, reflecting the asset's consumption, wear and tear, or obsolescence.

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated as depreciation expense since the asset was put into use.

Operating-Depreciation Expense

This refers to the portion of depreciation expense that is directly related to the operations of a business.

Q46: Define the debt-to-equity ratio.What is its purpose?

Q56: At December 31, 2013, HIJ had 2,000

Q57: Which of the following changes would be

Q65: At December 31, 2014, the shareholders' equity

Q68: The accounting classification of a financial instrument

Q72: The following information is available to you:

Q79: EGR Corporation has one asset worth $650,000.Accumulated

Q81: A reverse split may be used to

Q84: Temporary differences very seldom reverse (i.e., turnaround)in

Q95: At the end of Year 1, ABC