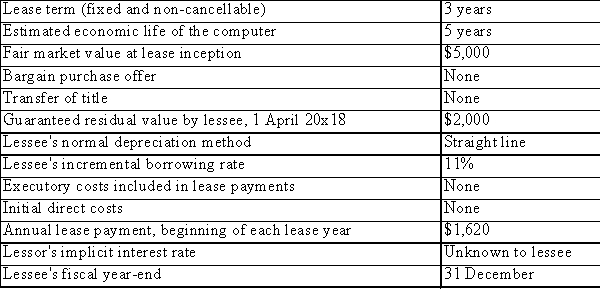

ABC Inc.leased a computer to the Lennox Silver Company on 1 April 2018.The terms of the lease are as follows:  *** ABC Inc.company charges a half-year depreciation in the year of acquisition and a half-year in the year of disposition, regardless of the actual dates of acquisition and disposal.

*** ABC Inc.company charges a half-year depreciation in the year of acquisition and a half-year in the year of disposition, regardless of the actual dates of acquisition and disposal.

Suppose that at the end of the lease, the lessor tells the lessee to dispose of the asset, and to keep any proceeds in excess of the guaranteed residual value.Provide entries for the lessee on 1 April 2014, assuming that the lessee sells the asset for $2,100 and remits the required $2,000 payment to the lessor.

Definitions:

Estimated Life

The expected period over which an asset is useful to the owning entity and can generate revenue, used for calculating depreciation.

Residual Value

The estimated salvage value of an asset at the end of its useful life, influencing depreciation calculations.

Present Value Tables

Tables used to find the present value of a future amount of money or stream of cash flows given a specified rate of return.

Original Investment

The initial amount of money used to purchase an asset or start a project, forming the basis for calculating returns or profit.

Q19: The following information is available to you:

Q27: The treatment of gains and losses under

Q29: Ending inventory for 20x0 is overstated in

Q41: The declaration and payment of a cash

Q42: KER commenced operations in 2013.The company had

Q51: What is a defined contribution plan?

Q60: When noncash assets are issued as a

Q85: A lessor leased equipment to a lessee

Q95: The following information pertains to XYZ Inc.:

Q134: With respect to convertible bonds, whose conversion