On January 1, 2014, LOR Company rented a machine (3-year life, no residual value, straight-line)to LEE Company for a cash rental payable each December 31, 20 11, 12, and x13.The rental is based on the regular sales price: cost, $35,665; sale price, $45,665.The agreed interest rate was 15% and the lessee retains the machine at the end of the lease term at no additional cost.

(a)The annual rental is $ _.

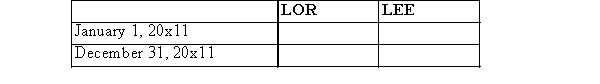

(b)Complete the following lease amortization schedule:  (c)Give the lessor's and lessee's entries on the following dates:

(c)Give the lessor's and lessee's entries on the following dates:

Definitions:

Great Britain

The island nation comprising England, Scotland, and Wales, which is part of the United Kingdom.

Pearl Harbor Attack

A surprise military strike by the Imperial Japanese Navy Air Service against the United States naval base at Pearl Harbor, Hawaii, on December 7, 1941, leading to the United States' entry into World War II.

Surprise Attack

A military tactic involving an unexpected assault on an adversary, with the intent of catching them off guard and gaining a tactical advantage.

Spanish-American War

A conflict fought between Spain and the United States in 1898, resulting in the U.S. gaining territories in the western Pacific and Latin America.

Q9: Provided that the conditions for share issuance

Q10: When a corporation issues a dividend in

Q34: Under the simplified approach to accounting for

Q47: A change in accounting principle occurs when

Q61: On January 20X2, ABC Corporation issued $1,000,000

Q66: In a defined contribution plan, employers run

Q90: DWWR purchased its own common shares for

Q116: If cash payments to investors are dependent

Q132: Amanda Corp.owned a major business building in

Q135: Company A enters into a lease agreement