Lamont Company leases computers for a three-year term, at the end of which they are regarded as

obsolete with no residual value because Lamont donates them to schools.Rents are collected at the end of each six-month period; the leases qualify as direct financing leases to Lamont (lessor).The computers cost Lamont $20,000 each.Lamont bases the rents on a 16% annual rate.

(a)The semi-annual rental on one computer, rounded to the nearest dollar, is $ _.

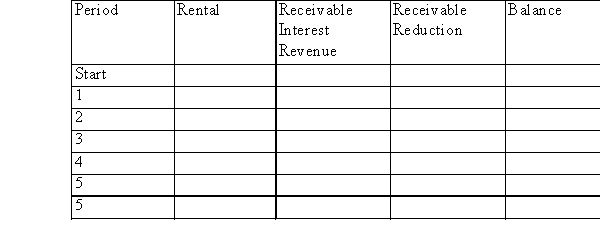

(b)Complete the following amortization schedule for the lease of one computer.  (c)Give the entries that should be made by the lessor on the following dates:

(c)Give the entries that should be made by the lessor on the following dates:

(1)At the date the lease is signed:

(2)At the date of collection of the first rental payment:

(d)Show the lessor's income statement and balance sheet amounts with respect to the lease immediately after the first rental collection:

Definitions:

Levator Scapulae

A muscle located in the back and neck that functions to elevate the scapula (shoulder blade).

Scapula

Bone forming the shoulder blade.

Pectoralis Minor

A thin, triangular muscle located beneath the pectoralis major in the chest, contributing to movements of the shoulder.

Rhomboideus Major

A skeletal muscle on the back that connects the spine to the scapula, playing a key role in retracting and stabilizing the shoulder.

Q14: Geisler Corp.provided you with the following information

Q15: If the corporation purchases common treasury stock,

Q23: Taxes are recovered at the tax rate

Q71: The term of a finance lease includes

Q82: Accounting recognition must be given to common

Q95: A firm reported the following in its

Q98: With respect to the computation of earnings

Q101: If a lease transfers the residual value

Q108: The term "taxable amount" includes:<br>A)Revenues that are

Q108: Mutual companies will tend to record their