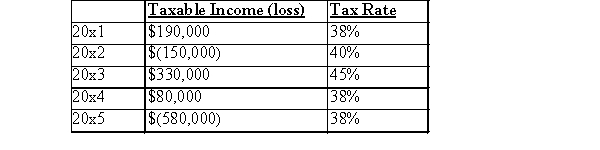

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be th carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be th carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

Definitions:

Sexual Act

Any activity that involves sexual contact or behavior intended to arouse or satisfy sexual desires.

Depersonalization-derealization Disorder

A dissociative disorder marked by periods of feeling disconnected or estranged from one's body and thoughts (depersonalization) or from one's surroundings (derealization).

Dissociative Identity Disorder

A disorder in which a person develops two or more distinct personalities. Previously known as multiple personality disorder.

Dissociative Amnesia

A mental health condition characterized by gaps in memory of personal information, often due to trauma.

Q5: Pension plans are drafted to meet Revenue

Q9: Assume that on January 1st, 20x1, Jane

Q16: Stock Appreciation Rights (SARS)earned by employees may

Q43: The use of inter-period income tax allocation

Q51: STR provided the following data related to

Q72: On January 1st, 2014, ABC Inc.(the lessor)agrees

Q88: Compensatory stock options were granted to executives

Q96: A characteristic of the taxes payable method

Q126: If a company issues debt that is

Q224: If a lessee does not exercise a