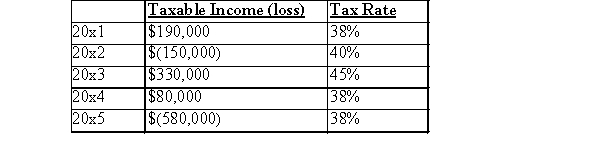

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still mor likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still mor likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

Definitions:

Dominance

The state or condition of having power and influence over others, often observed in social, economic, and ecological contexts.

Economic System

The structure of methods and principles a society uses to produce and distribute goods and services.

Great Depression

A severe worldwide economic downturn that took place during the 1930s, marked by high unemployment, widespread poverty, and deflation.

Q17: What guidelines are used under IFRS to

Q19: Which of the following statements is correct?<br>A)Par

Q85: As of January 1, 2013 there are

Q86: Options are in-the-money if the exercise price

Q87: Choose the correct statement concerning pensions (defined

Q110: Initial direct costs include lessor costs incurred:<br>A)after

Q131: Under ASPE, forfeitures which occur under a

Q134: With respect to convertible bonds, whose conversion

Q148: Dilutive convertible securities must be used in

Q154: Which of the following is not a