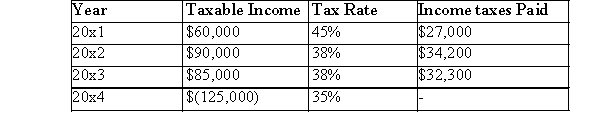

The following information for KEG Corporation is available:  KEG applies its tax losses sequentially, that is, tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

KEG applies its tax losses sequentially, that is, tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

Definitions:

Ambivalent Attachment

A type of insecure attachment where an individual simultaneously desires closeness with their caregiver but also resists it out of fear of rejection.

Percent

A measure expressed as a fraction of 100, representing a part of a total.

Avoidant Attachment

A type of attachment style characterized by difficulty in trusting others, emotional distance, and reluctance to depend on others for emotional support.

Anxious Attachment

A type of attachment characterized by insecurity and worry about relationships, often stemming from inconsistent caregiving experiences in childhood.

Q9: XYZ Inc.is a publicly traded company.At the

Q13: Past service costs that have vested must

Q38: EGR Company provided you with the following

Q40: Retractable preferred shares are always classified as

Q51: The measurement date of a compensatory stock

Q82: Defined benefit pension plans do not specify

Q105: Elizabeth Corp.owned a major business building in

Q111: Option adjustments are based on the treasury

Q114: In 20x1, an asset was purchased for

Q128: Stock options have no intrinsic value when