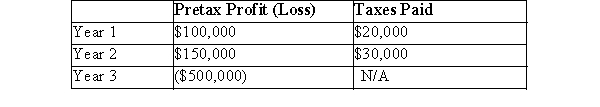

Loser Inc.reported the following pretax amounts for each of the last three years:  Additional Information:

Additional Information:

The tax rate in Year 3 and prior was 20%.The tax rate for Year 4 and beyond will be 25% and is known by Loser in Year 3.

At the start of Year 3, Loser had a DTL balance of $50,000 due to the excess of CCA over depreciation taken by Loser up to that date.During Year 3, the company took $110,000 more CCA than depreciation.

During Year 3 the company bought a parcel of land, which it had to write down during the same period due to environmental contamination rendering a portion of the land non-usable.The amount of the write-down was $40,000.

Loser Inc.has a policy of carrying tax losses back as far as possible and carrying forward the balance (the more-likely-than-not)criteria has been met for any tax loss carry-forwards.

Loser Inc.currently has no capital gains, but it expects to have enough capital gains in the future against which it will be able to use any capital loss carry forwards.

The company uses a single account for all of its deferred tax asset/liability balances.

Required:

Prepare all the journal entries and show all Deferred Tax Asset and/or Liability balances as at the end of Year 3.

Definitions:

Consumer Publication

A magazine or other publication that offers information and advice on consumer products and services.

Advertising Budget

The amount of money allocated towards advertising in order to promote a product, service, or brand.

Consumption Bundle

A collection or combination of various goods or services that an individual consumer purchases or consumes.

Slope

In mathematics, the slope of a line is a measure of its steepness, often calculated as the ratio of the vertical change to the horizontal change between two points on the line.

Q15: Jamieson's balance sheet as per IFRS for

Q37: Liquidating dividends are similar to stock dividends

Q67: JMR Corp.had one temporary difference during the

Q68: The accumulated benefit and projected unit credit

Q72: The following information is available to you:

Q86: What amount of sales is recognized by

Q92: Rights granted to existing shareholders entitling them

Q132: ABC Inc.has 20,000 common shares outstanding throughout

Q144: The estimated residual value of a depreciable

Q226: Choose the correct statement regarding the terms