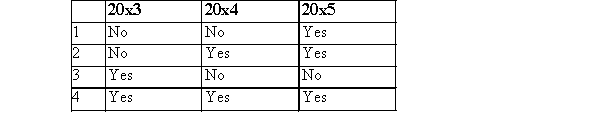

Compensatory stock options were granted to executives on January 1, 20x3, with a measurement date of June 30, 20x4, for services to be rendered during 20x3, 20x4, and 20x5.The excess of the market value of the shares over the option price at the measurement date was reasonably estimable at the date of grant.The stock option was exercised on October 31, 20x5.Compensation expense should be recognized in the income statement in which of the following years?

Definitions:

Difficult Employee

An employee who presents challenges to management due to their attitude, behavior, or work habits.

Dislikes

Refers to feelings of disapproval or aversion towards someone or something.

Tech-Savvy

Tech-Savvy individuals possess a high level of expertise and comfort with modern technology and digital devices.

Relevant Qualifications

The skills, experiences, and education that make an individual suitable for a particular job or task.

Q23: Retained earnings, if not designated otherwise, represents

Q27: In-substance defeasance means that a debtor irrevocably

Q28: A company has commenced work on a

Q50: Taxes are recovered at the rate at

Q62: A tax loss represents:<br>A)the final number of

Q65: Hedging is one method of minimizing foreign

Q66: The following information is available for Ryan

Q69: A company decides to relocate a group

Q79: How is the cash flow statement impacted

Q154: Which of the following is not a