On January 1st, 20x9, GHI Inc.granted options to its twenty employees allowing for the purchase of 12,000 shares at $5 per share.The options vest evenly over the 3 years following the date of issue.The options are only exercisable as of December 31st, 20x11.The fair value of these options (using an Option Pricing model)is $30,000.

Part A: Assume that all options have vested but that none were exercised on December 31st, 20x11.Provide the required journal entry.

Part B: Assume that all options have vested and all were exercised on December 31st, 20x11.Provid the required journal entry.

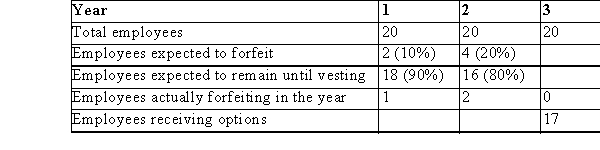

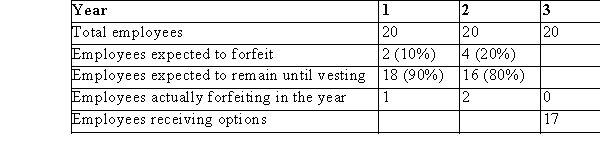

Part C: Suppose that some of the options were forfeited by the employees.Actual and estimated forfeiture data are provided in the table below:  Provide the required journal entries to record the accrual of compensation expense and the exercise o the options as per IFRS.

Provide the required journal entries to record the accrual of compensation expense and the exercise o the options as per IFRS.

Part D: Suppose that some of the options were forfeited by the employees.Actual and estimated forfeiture data are provided in the table below:  Provide the journal entries required under ASPE.

Provide the journal entries required under ASPE.

Definitions:

Male-Centred

A perspective or approach that prioritizes male experiences or viewpoints, often overlooking female perspectives.

Objectified

The treatment of a person or a group of people as an object, disregarding their personality or dignity, often leading to dehumanization.

Hegemonic

Pertaining to dominance, especially of one state or society over others.

Political Economic System

A theoretical framework that combines political science and economics to study the relationships between political policies, economic processes, and social structures.

Q12: KR Corporation was involved in a lawsuit

Q14: Ryan Company borrow $45,000 US when the

Q20: ABC Co.in its first year of business

Q39: Under a sales-type lease, the lessor recognizes

Q59: Stock dividends:<br>A)increase the total liabilities of the

Q61: Callable bonds are callable at the option

Q63: AB owes a $100,000, 8%, five-year note

Q70: Preferred shareholders normally have the same voting

Q82: A Corporation that incurs a taxable loss

Q220: Which of the following would be excluded