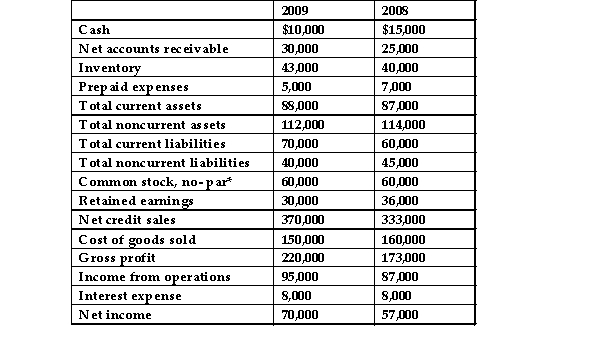

The following data represent selected information from the comparative income statement and balance sheet for Duenke Company for the years ended December 31, 2009 and 2008: * 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2008, and they were selling for $91.50 on December 31, 2009. Using 360 days in the year, Duenke Company's days' sales in receivables for the year ended December 31, 2009, was:

Using 360 days in the year, Duenke Company's days' sales in receivables for the year ended December 31, 2009, was:

Definitions:

Manufacturing Overhead Controllable Variance

Manufacturing Overhead Controllable Variance is the difference between the budgeted and actual manufacturing overhead costs that management has control over.

Flexible Manufacturing Overhead Budget

A plan that estimates the variable and fixed overhead costs for each level of production activity.

Direct Labor Hour

A measure of the labor directly involved in producing goods or services, expressed in hours.

Volume Overhead Variances

The difference between the budgeted overhead costs based on expected volume and the actual overhead costs incurred.

Q1: Revenues and expenses are specialized owners' equity

Q50: Liabilities and revenues are decreased by credits.

Q55: All of the following ratios directly relate

Q57: NewLook Company owns all of the stock

Q64: When using a four- column ledger account

Q68: Cash received from customers would be reported

Q82: Which of the following transactions would increase

Q108: Using the aging- of- accounts- receivable method

Q110: Under the allowance method, the entry to

Q113: Assets, owners' equity and dividends are all