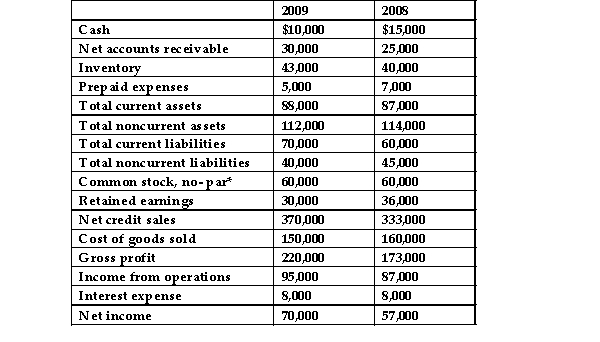

The following data represent selected information from the comparative income statement and balance sheet for Duenke Company for the years ended December 31, 2009 and 2008: * 10,000 shares of common stock have been issued and outstanding since the company was established. They had a market value of $90 per share on December 31, 2008, and they were selling for $91.50 on December 31, 2009. Duenke Company's times- interest- earned ratio for the year ended December 31, 2009, was:

Duenke Company's times- interest- earned ratio for the year ended December 31, 2009, was:

Definitions:

Variable Overhead Efficiency Variance

The difference between the actual variable overhead incurred and the standard cost of variable overhead that should have been incurred based on the efficiency of operations.

Favorable

An accounting term referring to actual results being better than projected or budgeted figures, often used in the context of variances.

Unfavorable

A term often used in finance and accounting to describe a variance or outcome that leads to a worse financial position than expected.

Volume Variance

The difference between the budgeted volume of production or sales and the actual volume, indicating whether a business performed better or worse than expected.

Q10: Deferral accounting provides some ethical challenges that

Q16: The payment for rent of the office

Q26: The indirect method of computing cash flows

Q27: Yukon Company has total current liabilities equal

Q28: Portia Incorporated uses the percentage- of- sales

Q34: The higher the inventory turnover figure, the

Q47: Under the indirect method of preparing a

Q67: Because it includes only cash and short-

Q73: Consider the following transactions: I. Borrowed cash

Q100: Adjusting journal entries recorded at the end