(Adapted from "Problem Eleven" from Chapter Six of previous editions of the textbook)

Alpha Ltd. is a Canadian-controlled private corporation operating a small land-development business 20x2, the company acquired a license to manufacture pre-fab homes and began operations immediate Financial information for the 20x2 taxation year is outlined below:

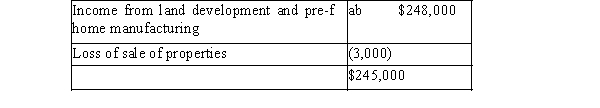

Alpha's profit before income taxes for the year ended November 30, 20x2, was $245,000, as follows:  The loss on sale of property results from two transactions. On October 1, 20x2, Alpha sold all of its s Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.)Also the year, Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

The loss on sale of property results from two transactions. On October 1, 20x2, Alpha sold all of its s Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.)Also the year, Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

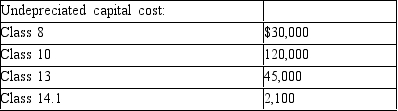

The 20x1 corporate tax return shows the following UCC balances:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At th Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time,

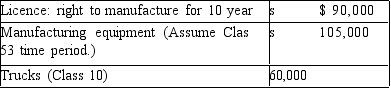

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At th Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time,

acquired the following:

Accounting amortization in 20x2 amounted to $60,000.

Accounting amortization in 20x2 amounted to $60,000.

Alpha normally acquires raw land, which it then develops into building lots for resale to individuals contractors. In 20x2, it sold part of its undeveloped land inventory to another developer for $400,000 realized a profit of $80,000, which is included in the land-development income above. The proceeds of $40,000 in cash, with the balance payable in five annual instalments beginning in 20x3.

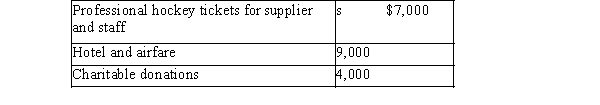

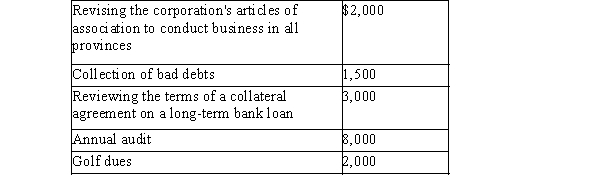

Travel and entertainment expense includes the following:  Legal and accounting expense includes the following:

Legal and accounting expense includes the following:  Required:

Required:

Calculate Alpha's net income for tax purposes for the 20x2 taxation year.

Definitions:

Nelson Rockefeller

An American businessman and politician who served as the 41st Vice President of the United States from 1974 to 1977 under President Gerald Ford and was the 49th Governor of New York.

Richard M. Nixon

37th President of the United States, known for his involvement in the Watergate scandal and eventual resignation.

Panama Canal

A significant engineering project completed in 1914, connecting the Atlantic and Pacific Oceans and significantly impacting global trade routes.

Spiro Agnew

The 39th Vice President of the United States, serving under President Richard Nixon, and known for his resignation due to accusations of bribery and tax fraud.

Q1: Sam Sherwood wishes to purchase Kitchen Cabinets,

Q3: Andy Griffin would like to invest $150,000

Q4: Certain skills are necessary for successful tax

Q6: The ACA mandates that every state create

Q6: What is the focus of health promotion

Q11: A manufacturer of automated optical inspection

Q16: The receipt of a stock dividend:<br>A)increases assets

Q16: What are the four basic values that

Q19: Why did states sue the federal government

Q31: Carve outs are health care services that