Stan is the sole shareholder of Hardware Ltd. Hardware purchased all of the shares of Tools Inc. in 20x4 for $500,000. Tools incurred a non-capital loss of $25,000 in the year ended December 31,

20x3. Stan has decided to initiate a Section 88 wind-up of Tools Inc. into Hardware Ltd. on June 23, 20x7. Due to the seasonal nature of his sales, Stan would like to maintain the April 30th year end that he has used since beginning his business.

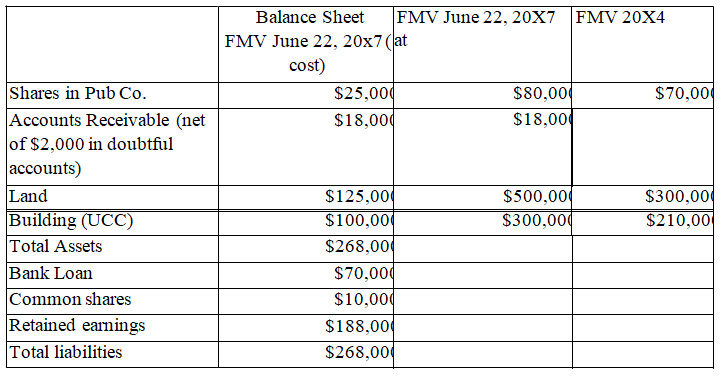

Stan's accountant has prepared the following balance sheet for Tools Inc. as of June 22, 20x7. The fair market value of the assets on both June 22, 20x7 and the date of acquisition in 20x4 are

presented in the following table:

Tool paid dividends of $8,000 to Hardware in 20x7.

Required:

Answer the following questions (filling in the charts where provided):

1) Immediately following the windup, Hardware will report the following assets at what values?

2) Calculate the value of the section 88(1)(d) "bump" available on the ACB for the non-depreciable capital property.

3) Identify the assets which may use the bump, and the amount of the bump available for each asset identified. Identify any unusable bump amount.

4) When will Hardware be able to use the non-capital loss from Tools.

Definitions:

Inventory Turnover

A ratio indicating how many times a company's inventory is sold and replaced over a specific period.

Inventory

Refers to the goods and materials a business holds for the purpose of resale or production.

Cost Of Goods Sold

Costs that are directly related to the production of goods a company sells, encompassing expenses for labor and materials.

Profit Margin

A financial metric indicating the percentage of revenue that exceeds the cost of goods sold, highlighting the profitability of a company.

Q2: Two delivery methods have been proposed

Q4: List the six general limitations to business

Q5: An engineer- to- order manufacturer is considering

Q7: The cost of building the gondola lift

Q8: Chiropractors have a holistic approach to treating

Q11: What are phobias?<br>A)Excessive fear of objects<br>B)Excessive fear

Q11: The Physician Compare website is established to

Q15: The Consolidate Omnibus Budget Reconciliation Act of

Q18: The American Hospital Association is:<br>A)A membership organization

Q20: Proprietary hospitals or investor-owned hospitals are for