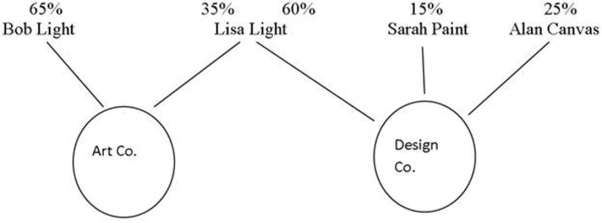

The following diagram depicts the ownership structure of two CCPCs. Bob Light is Lisa Light's son.

Sarah Paint and Alan Canvas are not related to Bob and Lisa in any manner, whatsoever, or to one another. All of the shares held are common.

Required:

Required:

A)Determine if the two companies are associated, referring to the applicable section of the Income Tax Act.

B)Briefly explain what the most significant tax implication is when two or more corporations are associated.

Definitions:

Fidelity Bond

An employer’s insurance against an employee’s wrongful conduct.

Employer

An individual or organization that hires and pays for the services of workers.

Life Insurance

A contract between an insurer and an insured that guarantees payment to named beneficiaries upon the death of the insured.

Pay-outs

Pay-outs refer to amounts of money paid to someone, often as part of a settlement, as earnings or as a distribution from investments.

Q1: A major bakery- cafe chain is

Q1: The Lilly Ledbetter Fair Pay Act of

Q2: Psychiatrists, who also participate in the treatment

Q6: George and Gina Anderson, (Canadian citizens), moved

Q14: Determine the rate of return of

Q17: Upon his employment at the age of

Q23: Alzheimer's disease causes the death brain cells

Q26: The most common mental disorders include phobias

Q29: Public health marketing draws from the business

Q66: Expenses are:<br>A)increases in retained earnings resulting from