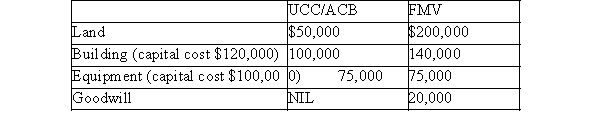

Ben is incorporating his proprietorship and would like to transfer the following capital assets to the new corporation.  Ben will also transfer his inventory. The inventory originally cost $25,000 and has a fair market value $30,000.

Ben will also transfer his inventory. The inventory originally cost $25,000 and has a fair market value $30,000.

Ben wishes to defer all gains at this time so has elected to use a section 85 rollover. He will receive the maximum note receivable possible and the remainder of the transfer in preferred shares.

Required:

A)What is the elected value for each of the assets transferred under section 85?

B)What is the value of the note receivable that Ben will receive from those assets which benefit from section 85? (Show the amounts for each asset, and the total for all.)

C)What is the value of the preferred shares that Ben must receive in order to defer any income inclusions at this point in time?

Definitions:

Codes Of Conduct

Written guidelines that outline ethical standards, expectations, and practices for behavior within an organization or profession.

Ethical Climate

The collective moral attitudes, standards, and values that shape the behavior, practices, and decision-making within an organization.

Stakeholders' Trust

The confidence that shareholders, customers, employees, and other people who have an interest in the organization have in the company's ability to meet its obligations and act in their best interests.

Strategic Philanthropy

A form of corporate social responsibility where companies align charitable activities with their strategic business goals, enhancing both societal and business outcomes.

Q2: Why are life expectancy rates calculated?<br>A)They calculate

Q3: Which of the following statements regarding debt

Q7: The estimated cash flows of an

Q10: Which of the following scenarios illustrates a

Q10: Explain the concept of the graying of

Q11: What are the four models identified by

Q11: The most common type of healthcare services

Q14: Two grandparents are considering purchasing a baby

Q28: As the types of MCOs have evolved

Q89: The accounting equation must always be in