Figure 4.2

Figure 4.2

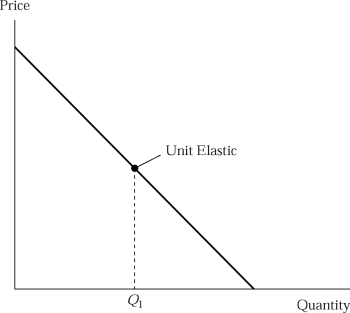

-In Figure 4.2 at quantities smaller than Q1 demand is:

Definitions:

Yield To Maturity

The total return anticipated on a bond if the bond is held until it matures, considering all payments of principal and interest.

Duration

A measure of the sensitivity of a bond's price to changes in interest rates, representing the weighted average of the time until a bond's cash flows are received.

Basis Points

A unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument, where one basis point is equal to 1/100th of 1%.

Modified Duration

A measure of the sensitivity of a bond's price to changes in interest rates, adjusted to account for changes in yield.

Q7: Technological advancement in oil exploration will, ceteris

Q53: Refer to Table 4.3. A change in

Q55: In considering the costs involved for student

Q59: When there is a change in the

Q94: The market demand curve<br>A)shows the relationship between

Q98: Explain the real-nominal principle.

Q127: Suppose that the percentage change in demand

Q166: Figure 3.2 illustrates the supply and demand

Q172: On the ʺdemand sideʺ of a market,

Q200: The marginal cost curve always intersects the