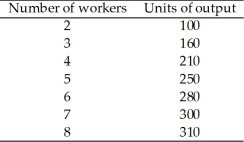

Table 10.1

Table 10.1

-Refer to Table 10.1. If the price of output is $2 per unit and the wage rate is $60, ________ workers should be hired.

Definitions:

Net Pay

The amount of money a worker takes home after all deductions, such as taxes and retirement contributions, have been subtracted from the gross salary.

Social Security Tax

The amount of Social Security a worker pays depends on the Social Security percentage and the maximum taxable income for that year; the amount is split between the employee and the employer.

Medicare Tax

A federal tax deducted from employees' paychecks to fund the Medicare program, which provides healthcare to seniors.

Federal Withholding

The amount of an employee's pay withheld by the employer and sent directly to the government as partial payment of taxes.

Q39: The amount of income that households keep

Q50: When real GDP falls for two consecutive

Q73: We ADD to the GDP when goods

Q86: During pledge week your local public television

Q106: Figure 9.4 represents the market for used

Q107: According to this Application, if you are

Q135: If Cassieʹs Coffee House purchases 33 cents

Q198: If the substitution effect of wage increases

Q269: You are responsible for purchasing 25 used

Q372: If two firms have different abatement costs,