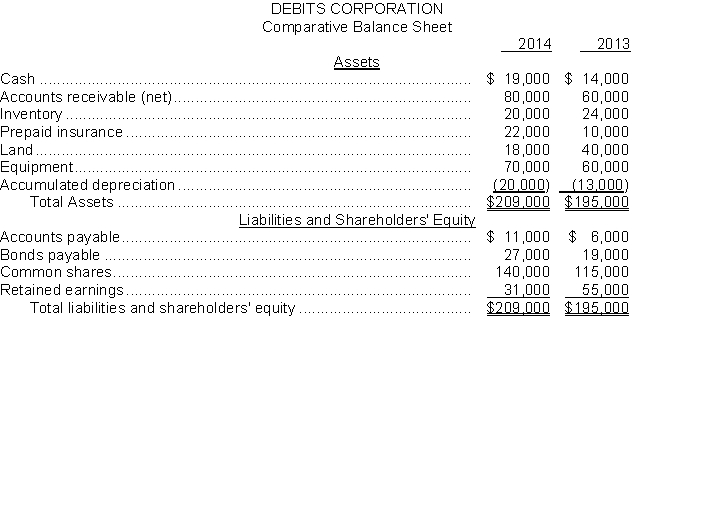

A comparative balance sheet for Debits Corporation is presented below:

Additional information:

1. Loss for 2014 is $20,000.

2. Cash dividends of $4,000 were declared and paid in 2014.

3. Land was sold for cash at a loss of $10,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5. $12,000 of bonds were retired during the year at carrying value.

6. Equipment was acquired for common shares. The fair value of the equipment at the time of the exchange was $25,000.

Instructions

Prepare a cash flow statement for the year ended 2014, using the indirect method.

Definitions:

Hyoid Bone

A horseshoe-shaped bone in the neck that supports the tongue and is involved in the process of swallowing.

Fontanels

Soft spots on a baby's skull where the bones have not yet fused together, allowing for growth of the brain and skull during infancy.

Dehydration

A condition caused by the excessive loss of water from the body, exceeding the amount of water being taken in, leading to a deficiency in bodily fluids.

Sunken

Describes something that has fallen below the surrounding level or area, often used in reference to eyes or cheeks due to illness or malnutrition.

Q8: Chan Inc. has a profit of $1,000,000

Q14: Which of the following is a corporation

Q31: Which of the following persons is not

Q32: Corporate income tax is based on the

Q38: During 2014, Quest Corporation had the following

Q71: Which of the following parties cannot be

Q105: The income statement for Woodford Corporation for

Q110: A shareholder who receives a stock dividend

Q138: Which of the following statements is INCORRECT

Q154: Lee Holdings Ltd. was incorporated on January