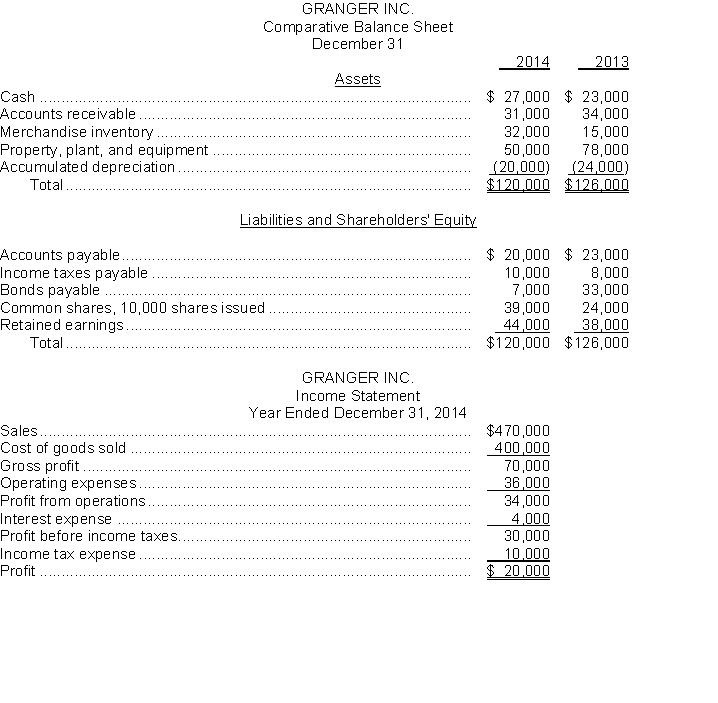

The financial statements of Granger Inc. appear below:  The following additional data were provided:

The following additional data were provided:

1. Dividends declared and paid were $14,000.

2. During the year, equipment was sold for $12,000 cash. This equipment cost $28,000 originally and had a carrying amount of $12,000 at the time of sale.

3. All depreciation expense is in the operating expenses category.

4. All sales and purchases are on account.

5. Accounts payable pertain to merchandise suppliers.

6. All operating expenses except for depreciation were paid in cash.

Instructions

a. Prepare a cash flow statement for Granger Inc., using the direct method.

b. Calculate free cash flow.

Definitions:

Inventory Loss

A reduction in inventory count due to theft, spoilage, or other discrepancies not related to sales.

Ceiling Constraint

The maximum limit or cap placed on the budget, price, or resources applicable within a project or operation.

Normal Profit Margin

The average amount by which a company's sales exceed its costs of goods sold and operating expenses, reflecting a typical level of profitability.

Transportation Costs

Expenses incurred by a company to move its products from the place of production to the place of sale.

Q8: Chan Inc. has a profit of $1,000,000

Q26: When equipment is sold for cash, the

Q57: Most of the largest Canadian companies are

Q69: The FWPCA was first passed in<br>A) 1900.<br>B)

Q87: When recording a retirement of bonds, a

Q98: Dividends are distributed from retained earnings.

Q99: Which one of the following would NOT

Q107: The maturity date of the bond is

Q133: The Bankruptcy Code has_ chapters.<br>A) three<br>B) five<br>C)

Q167: Assuming that the preferred dividends have not